inheritance tax wisconsin rates

In fact only seven states have an inheritance tax. Wisconsin is a moderately tax friendly state.

Jackson County Mo Property Tax Calculator Smartasset

Inheritance and Estate Taxes.

. Structure of Death and Gift Taxes. There is no Wisconsin inheritance tax for decedents dying on or after January 1 1992. Note that historical rates and tax laws may differ.

Does Wisconsin Have an Inheritance Tax Attorney Burton discusses how the inheritance tax works in the United States and discusses how the Wisconsin tax system interacts with the federal estate and gift tax system. Below are the ranges of inheritance tax rates for each state in 2021 and 2022. The District of Columbia moved in the.

Wisconsin does not levy an inheritance tax or an estate tax. In those states the only tax that would apply is the federal estate tax on estates worth over 117 million. You can do it right here in Wisconsin.

ESBT income is taxed at a rate of 765 percent. The state income tax rates range from 0 to 765 and the sales tax rate is 5. Its a great reason to live in the state of Wisconsin and even spend your final days in the state of Wisconsin.

To Wisconsin Statutes Administrative Rules Wisconsin Tax Bulletins ISE Publications and Attorney Generals Opinions. However like every other state Wisconsin has its own inheritance laws including what happens if the decedent dies without a valid will. Brief history of the inheritance tax rates in wisconsin written by anonim published by anonim which was released on.

Married couples can avoid taxes as long as the estate is valued at under 2412 million. Rule Tax Bulletin and Publication P AGO A A. Florida is a well-known state with no estate tax as well.

Inheritance tax of up to 15 percent. Estate tax of 10 percent to 20 percent on estates above 55 million. But you dont have to go to Florida to avoid the state estate tax.

The property tax rates are among some of the highest in the country at around 2. But currently Wisconsin has no inheritance tax. Vermont also continued phasing in an estate exemption increase raising the exemption to 5 million on January 1 compared to 45 million in 2020.

Connecticuts estate tax will have a flat rate of 12 percent by 2023. There is no federal inheritance tax but there is a federal estate tax. Rate of tax see Tax rates.

ESBT that has Wisconsin sourced income or. The top estate tax rate is 16 percent exemption threshold. Trusts and Estate Tax Rates of 2022.

But really any property you own is subject to capital gains tax if you sell it for more than the original purchase price. Wisconsin offers tax deductions and credits to reduce your tax liability including. Wisconsin also has a sales tax between 5 to 6 and counties can.

No estate tax or inheritance tax. Wisconsin Inheritance Tax Return. The top estate tax rate is 16 percent exemption threshold.

Estates Inheritance rights Taxes and estate planning. This increases to 3 million in 2020 Mississippi. Estate tax of 8 percent to 12 percent on estates above 58 million.

A strong estate plan starts with life insurance. However if you are inheriting property from another state that state may have an. Estate tax of 08 percent to 16 percent on estates above 4 million.

Additionally the new higher exemption means that theres room for them to give away another 720000 in 2022. Gift tax and inheritance tax. No estate tax or inheritance tax.

If death occurred prior to January 1 1992 contact the Department of Revenue at 608 266-2772 to obtain the appropriate forms. Information about the Wisconsin inheritance and gift taxes which were imposed prior to 1992 is presented in the Appendix. In 2020 rates started at 10 percent while the lowest rate in 2021 is 108 percent.

GENERAL TOPICAL INDEX. Download brief history of the inheritance tax rates in wisconsin books now. In 2022 federal estate tax generally applies to assets over 1206 million and the estate tax rate ranges from 18 to 40.

State Inheritance tax rate. The federal estate tax has a progressive scale and may reach as high as 40 in certain cases. State inheritance tax rates in 2021 2022.

INHERITANCE AND ESTATE TAX. No estate tax or inheritance tax. That is why it is so important to be very careful with estate planning.

In 2022 an individual can leave 1206 million to their heirs without paying any federal estate or gift tax. Wisconsin also does not have any gift tax or inheritance tax. Except for the top tax rates the same rates apply after 2001.

Wisconsin does not have a state inheritance or estate tax. Burton answers the following question. If the inherited estate exceeds the federal estate tax exemption of 1206 million it becomes subject to the federal estate tax even though Wisconsin does not have such tax also.

Inheritance tax of up to 16 percent. However the top tax rate dropped to 50 for 2002 with annual decreases of 1 thereafter through 2007. The maximum credit is 1168.

Is Your Inheritance Considered Taxable Income H R Block

Tax Optimization Tax Planning Bogart Wealth

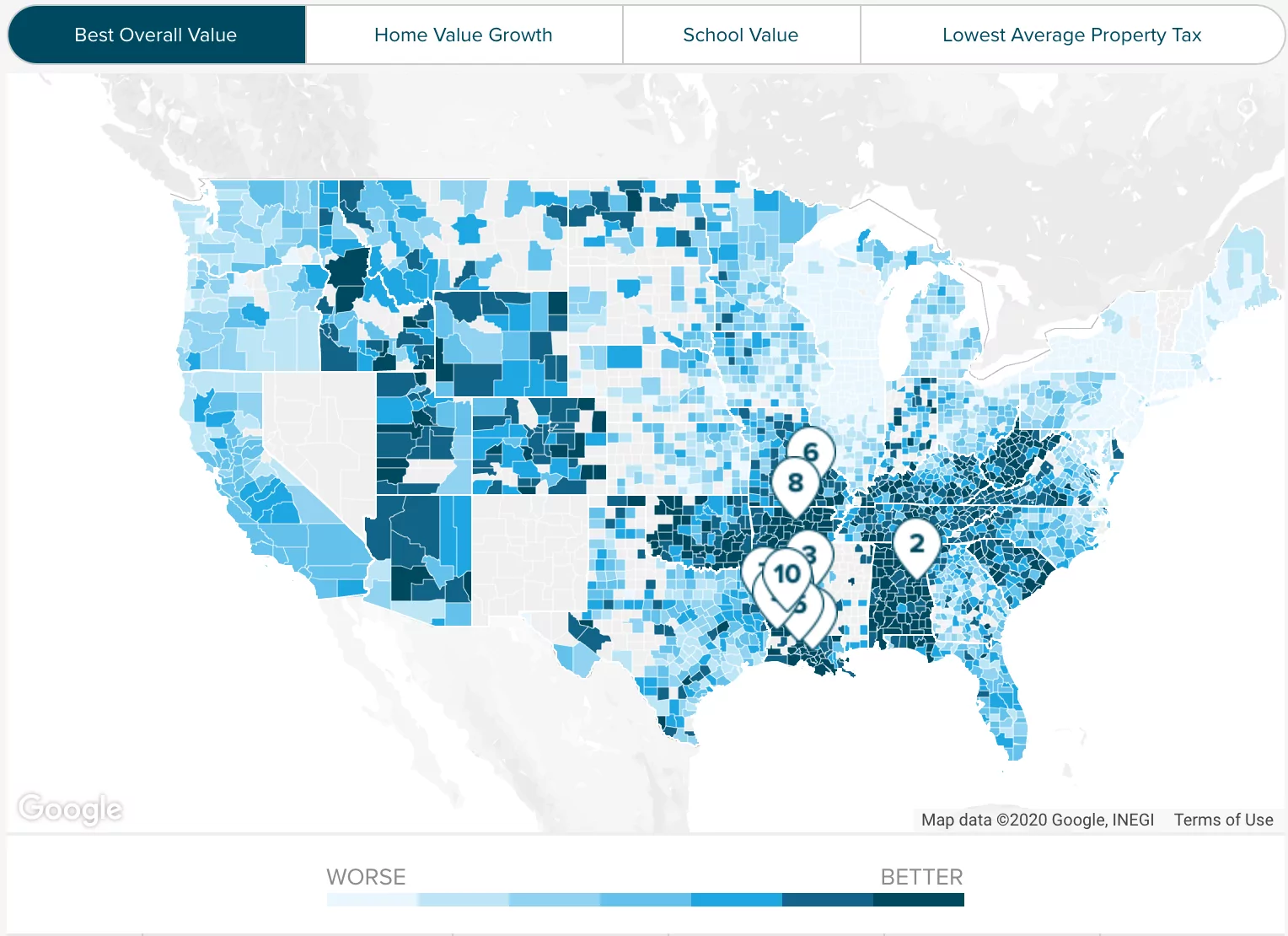

Median United States Property Taxes Statistics By State States With The Best Worst Real Estate Tax Rates

Who Pays What In The Los Angeles County Transfer Tax

Business Property Taxes Tax Foundation

The New Administration Brings Several Potential Tax Law Changes

Median United States Property Taxes Statistics By State States With The Best Worst Real Estate Tax Rates

Business Property Taxes Tax Foundation

Business Property Taxes Tax Foundation

Business Property Taxes Tax Foundation

Median United States Property Taxes Statistics By State States With The Best Worst Real Estate Tax Rates

Property Tax Payments Outagamie County Wi

Business Property Taxes Tax Foundation